It is no doubt that money apps are a convenient way to send and receive money today, but also these are methods scammers can use them to steal your funds. Customers of Bank of America filed a class-action lawsuit against the bank that co-owned Zelle app, claiming that using Zelle exposes them to a high risk of fraud. These are the Zelle users that were scammed.

In the month of October alone, U.S. Senator Elizabeth Warren had released a report in which more than 190,000 cases of scams was reported: dating from January 2021-June 2022. This was among the four banks that partly own Zelle.

According to a recent Pew Research Center survey, the data showed that people fallen victim to scams on other money transfer apps as well. 13% of money transfer app user who uses Paypal, Zelle, Venmo or Cash App confessed they have been scammed into sending money to someone as they later realsied they have been scammed. The same data also showed that 11% of these users reported their accounts had been hacked on the said money apps. These data reports are signs how bad Zelle users have been scammed within a short time.

Scams on Money Transfer Apps

When someone mistypes a username, he or she is likely to send money to the wrong person. Again, someone who sends you money by mistake may be attempting to defraud you. Report released by the Better Business Bureau (BBB), most scammers link stolen credit cards to their digital wallets and use them to transfer money out of their money transfer app. Once someone transfers the money back to them, they remove the stolen credit card and put their personal information; thereby ensuring that the funds are deposited into their account.

How to Avoid Being Scammed on Money Transfer Apps

Step #1:

Always try to maintain using the money transfer apps to send payments to people you personally know. When someone contacts you and informs you that he or she sent you money by mistake, ask them to cancel the transaction. doing this would prevent you from falling among the people that can be counted ad Zelle user that were scammed.

Step #2

Always protect your account with additional security measures, such as Two-factor Authentication (2FA), multi-factor authentication (MFA), Touch ID and Face ID.

Step #3

Ensure to link your account to a credit card. Survey has shown that when credit cards are linked, they typically provide additional security if you don’t receive goods or services you paid for.

Step #4: Use a Strong Password

When you are using a money transfer app like Zelle or other to sell something (or perhaps buy something), always ensure the transaction has cleared before sending the item.

Step #5: What to Do If You Suspect Fraud

If the inevitable, and you have fallen victim to the scam move already, the Federal Trade Commission (FTC) advises that you report the transaction to the Zelle app company at once and ask the transaction be reversed. Also, if the app has been linked to your credit card or debit card, you should report the scam to your bank immediately.

Read More

Anti-Theft and Burglar System with SMS Notification

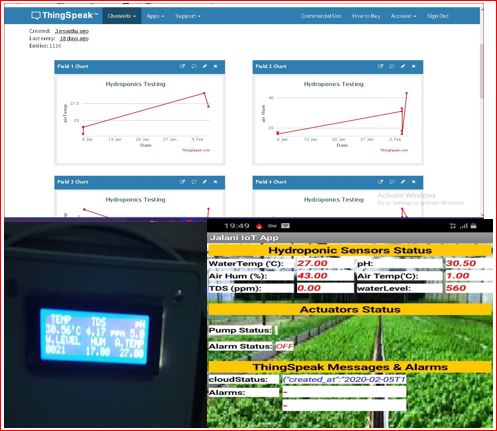

How to build a Smart Hydroponics IoT Project

Conclusion

Zelle users have been scammed without realizing they are being scammed until when the cloud clears and what they were expecting is not what they are given. We hope these stepped listed would help avoid future cases. Let us know if you had any experience of such ugly encounter in the comment.