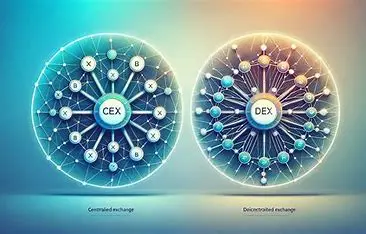

Cryptocurrency trading has revolutionized the financial industry, offering individuals around the world an alternative way to invest, store, and grow their wealth. However, as the market has expanded, so has the number of platforms available for trading digital assets. The two primary types of platforms that dominate the space are centralized and decentralized exchanges (DEX). Each has its own unique advantages and risks, making it essential for traders to understand the differences and determine which is safer to use for their trading activities.

This comprehensive guide aims to dive deep into the world of centralized and decentralized exchanges platforms, examining their core features, benefits, drawbacks, and the factors that make them either secure or vulnerable. By the end of this article, you’ll have a clearer understanding of which platform aligns with your trading needs and, most importantly, which one offers a safer environment for your crypto assets.

1. Understanding Centralized Exchanges (CEX)

Centralized exchanges are the traditional gateways for most newcomers into the cryptocurrency market. These platforms are run by organizations that act as intermediaries between buyers and sellers, offering a controlled environment for trading cryptocurrencies. Popular examples of CEXs include Binance, Coinbase, Kraken, and Bitfinex.

How Centralized Exchanges Work:

- Custodianship of Funds: Users deposit their funds into the exchange’s wallets. The exchange then takes custody of the assets, managing private keys and ensuring liquidity for trading.

- Order Matching and Execution: The exchange operates as a marketplace, matching buy and sell orders from its users. This central order book allows for high liquidity and efficient trade execution.

- User Interface and Experience: CEX platforms often provide a user-friendly interface, making it easy for traders to access charts, tools, and educational resources.

Advantages of CEX:

- High Liquidity: Centralized exchanges generally have more liquidity, making it easier for traders to buy and sell large amounts of cryptocurrencies without significant price slippage.

- Ease of Use: Their user interfaces are typically intuitive, catering to beginners and seasoned traders alike.

- Regulation and Compliance: Most CEX platforms operate under government regulations, ensuring a certain level of transparency and accountability.

- Advanced Trading Features: CEXs offer advanced trading options such as margin trading, futures, and staking, which are not always available on DEXs.

Drawbacks of CEX:

- Custodianship Risk: When you store your assets on a CEX, you are essentially handing over your funds to a third party. This centralization of control can make the exchange a target for hackers.

- Regulatory Concerns: CEX platforms are subject to regulations, which means they can be restricted or shut down by authorities. Users in certain jurisdictions might face difficulties accessing their funds.

- Privacy Issues: Most centralized exchanges require users to complete KYC (Know Your Customer) procedures, compromising anonymity and privacy.

2. Understanding Decentralized Exchanges (DEX)

Decentralized exchanges operate differently from their centralized counterparts. They are built on blockchain technology and allow users to trade directly from their wallets without the need for an intermediary. Popular DEXs include Uniswap, PancakeSwap, SushiSwap, and Curve Finance.

How Decentralized Exchanges Work:

- Non-Custodial Nature: Users retain control over their private keys and funds at all times. Trades are executed directly from the user’s wallet.

- Smart Contracts: DEX platforms utilize smart contracts to facilitate trading between users. These automated contracts enforce the rules of the transaction without human intervention.

- Liquidity Pools: Instead of traditional order books, many DEXs use liquidity pools where users contribute their assets to enable trading pairs. Liquidity providers earn a share of transaction fees in return.

Advantages of DEX:

- Ownership of Funds: Users maintain full control of their assets, significantly reducing custodianship risk.

- Privacy and Anonymity: Most DEXs do not require KYC procedures, allowing users to trade without revealing personal information.

- Resilience to Censorship: Due to their decentralized nature, these platforms are less susceptible to regulatory shutdowns and censorship.

Drawbacks of DEX:

- Lower Liquidity: While growing rapidly, DEXs still have lower liquidity compared to CEXs, which can result in higher slippage and less efficient trade execution.

- Complexity and User Experience: DEX platforms often have a steeper learning curve, making them less accessible to beginners.

- Smart Contract Vulnerabilities: While smart contracts offer automation, they are not foolproof. Bugs or vulnerabilities in the code can be exploited, leading to potential loss of funds.

3. Security Aspects of CEX vs. DEX

Security is a critical factor in deciding between using a centralized and decentralized exchanges Let’s analyze the security implications of both:

Security of CEX:

- Custodial Risk: CEXs take custody of users’ funds, making them prime targets for hackers. Several exchanges have faced hacks over the years, resulting in millions of dollars lost. For instance, the Mt. Gox hack in 2014 resulted in the loss of 850,000 BTC, while the more recent 2021 hack on BitMart saw $196 million stolen.

- Internal Fraud and Mismanagement: Being centrally managed, CEXs are vulnerable to internal fraud or mismanagement. The 2019 QuadrigaCX incident, where users lost access to $190 million after the founder’s death, is a prime example.

- Regulation and Compliance: While regulations provide a layer of security, they can also lead to sudden restrictions, freezing of funds, or account suspensions.

Security of DEX:

- Non-Custodial Nature: DEXs allow users to retain control over their funds, minimizing the risk of large-scale hacks.

- Smart Contract Risks: Bugs or vulnerabilities in smart contracts can be exploited. In 2020, the DeFi platform bZx suffered multiple exploits, leading to significant losses.

- Front-Running Attacks: DEXs are susceptible to front-running, where malicious actors manipulate transaction order for profit. This is due to the transparent nature of blockchain transactions.

4. Factors to Consider for Security in DEX and CEX

Whether you choose a DEX or a CEX, several factors can affect your security and trading experience:

1. Custodianship of Funds:

- CEX: Funds are held in the exchange’s wallet, making it vulnerable to hacks and potential mismanagement.

- DEX: Users retain full custody of their funds, significantly reducing the risk of losing assets due to exchange hacks.

2. Regulatory Environment:

- CEX: Heavily regulated, which can provide a sense of security but may also result in restrictions or the freezing of assets.

- DEX: Generally unregulated, offering greater privacy but less protection in case of disputes or losses.

3. Liquidity:

- CEX: High liquidity, leading to efficient trade execution and minimal price slippage.

- DEX: Lower liquidity, especially for less popular trading pairs, which can result in significant slippage.

4. Transparency:

- CEX: Less transparent, as internal operations are not visible to users.

- DEX: Transparent and verifiable on the blockchain, but susceptible to front-running and manipulation.

5. Fees and Costs:

- CEX: Fees can vary widely and often include trading fees, withdrawal fees, and deposit fees.

- DEX: Fees are typically lower, but network congestion and gas fees can sometimes make trading more expensive.

5. Which is Safer: DEX or CEX?

The question of safety between DEX and CEX is complex and depends on several factors:

Use Cases Where CEX is Safer:

- New Traders: Centralized exchanges provide a more user-friendly experience, making it easier for beginners to navigate the crypto trading landscape.

- High Liquidity Requirements: If you’re trading large volumes, the higher liquidity on CEXs can reduce slippage and improve trade execution.

- Advanced Trading Needs: For traders who require advanced trading options such as futures or margin trading, CEXs are generally more equipped.

Use Cases Where DEX is Safer:

- Security Concerns: If the main priority is control over assets and security, DEXs offer a non-custodial environment where users retain control over their private keys.

- Privacy: For users who prioritize anonymity and privacy, DEXs do not require KYC, allowing for a more private trading experience.

- Censorship Resistance: DEXs are less susceptible to regulatory shutdowns and provide a censorship-resistant platform for trading.

6. Best Practices for Safe Trading

Regardless of whether you choose a centralized and decentralized exchanges consider the following best practices to enhance your security:

- Use Strong Authentication: Enable two-factor authentication (2FA) on CEXs and ensure that your private keys are stored securely for DEX use.

- Research Platforms: Before using any platform, research its history, security protocols, and community feedback.

- Avoid Leaving Funds on Exchanges: Even if you are using a CEX, avoid leaving large sums of money on the exchange for long periods. Use hardware wallets for long-term storage.

- Stay Updated on Security News: Keep abreast of the latest security incidents, vulnerabilities, and platform updates.

7. Conclusion: Choosing the Right Platform

The debate between CEX and DEX boils down to individual preferences, trading needs, and risk tolerance. If you value ease of use, high liquidity, and advanced trading features, a CEX might be more suitable. However, if you prioritize security, privacy, and control over your assets, a DEX is likely the better option.

Ultimately, the safest approach is to remain informed, practice good security hygiene, and choose a platform that aligns with your specific trading goals. By weighing the pros and cons of each exchange type, you can make an educated decision that suits your crypto trading journey.

8. FAQs

1. Are DEXs completely safe?

- While DEXs minimize custodial risks, they are not without vulnerabilities. Smart contract bugs and potential front-running attacks are considerations for users.

2. Can I trade on both DEX and CEX?

- Yes, many traders use both types of exchanges to take advantage of the benefits each offers.

3. What is the best practice for storing crypto?

- Use hardware wallets for long-term storage, and only keep what you need for trading on exchanges.

4. How do I ensure the DEX I choose is secure?

- Research the DEX’s history, check for audits, and read community feedback.

5. Are CEXs regulated?

- Yes, most centralized exchanges operate under specific regulations, which can vary by country.

Final Thoughts

In the rapidly evolving world of cryptocurrency, understanding the nuances between decentralized and centralized exchanges is crucial for anyone looking to engage in trading. Both types of exchanges have their merits and risks, and the choice ultimately depends on your individual preferences and risk tolerance.

By following best practices for security and remaining vigilant, you can navigate the crypto trading landscape safely, maximizing your opportunities while minimizing risks.

Explore Related Article

- How to Know the Best Cryptocurrency Exchanges for your Investment

- How to Convert Telegram Mini Apps Airdrop to Local Currency: A Step-by-Step Guide

- How to Play the Bybit CoinSweeper Telegram Mini Game

- Upwork vs. Fiverr: Which Platform is Best for Freelancers?