Introduction

IoT in smart crop insurance, Agriculture is the backbone of many economies worldwide, but it’s also one of the most unpredictable industries. Farmers constantly battle unpredictable weather, pests, and market fluctuations. Traditional crop insurance models have been around for decades, but they often fail to provide real-time, accurate assessments of risk. Enter AI and IoT two revolutionary technologies reshaping crop insurance into a smarter, data-driven model that benefits both insurers and farmers.

White Nationalism and Online Radicalization: Unmasking the Alt-Right

Understanding Smart Crop Insurance

Smart crop insurance integrates artificial intelligence (AI) and the Internet of Things (IoT) to provide more accurate risk assessments and faster claim settlements. By leveraging real-time data, these models ensure that farmers receive fair compensation while reducing fraud and inefficiencies in the system.

How Traditional Crop Insurance Works

Traditional crop insurance relies on historical data, manual field assessments, and generalized risk models. Farmers often face delays in claim settlements, disputes over coverage, and an overall lack of transparency.

Why Traditional Models Fall Short

- Delayed Assessments: Farmers often wait months for claim approvals.

- Generalized Risk Calculations: Traditional models don’t factor in real-time weather and soil conditions.

- Fraudulent Claims: The manual process makes it easier for fraudulent claims to slip through.

- Lack of Personalized Coverage: One-size-fits-all policies don’t cater to the unique risks of each farm.

The Role of AI in Smart Crop Insurance

AI-Powered Risk Assessment

AI models analyze historical and real-time data to assess risks more accurately. These models take into account:

- Weather patterns

- Soil moisture levels

- Crop health using satellite imagery

- Pest infestation risks

Predictive Analytics for Risk Mitigation

Using machine learning, AI can predict potential threats to crops and suggest preventive measures. For example, if an AI model detects an incoming drought, it can alert insurers and farmers, allowing them to take necessary actions.

Automated Claim Processing

AI speeds up claim verification by cross-referencing satellite images, weather reports, and IoT sensor data. This reduces paperwork, minimizes errors, and accelerates payouts for farmers.

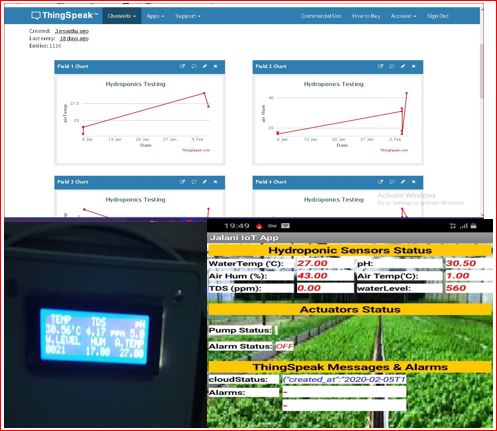

How IoT Enhances Crop Insurance Models

Real-Time Data Collection

IoT devices like soil sensors, drones, and weather stations collect real-time data on:

- Temperature and humidity

- Rainfall levels

- Soil nutrients

- Crop growth stages

Remote Sensing for Damage Assessment

IoT-enabled drones can assess crop damage remotely, reducing the need for physical inspections. This not only speeds up claims but also ensures accuracy in damage assessment.

Early Warning Systems

By analyzing IoT data, insurers and farmers can receive alerts about potential risks like drought, pest infestations, or excessive rainfall, allowing them to take preventive measures.

Benefits of AI and IoT in Crop Insurance

Faster Claim Processing

AI and IoT eliminate the need for manual inspections, reducing claim settlement time from months to days.

Fairer Premium Pricing

Insurers can offer personalized premiums based on real-time risk factors rather than historical averages, making insurance more affordable for farmers.

Reduced Fraud

With AI analyzing patterns and IoT providing real-time data, fraudulent claims become easier to detect and eliminate.

Increased Transparency

Farmers can access their farm data, insurance coverage details, and claim status in real-time, fostering trust in the system.

Challenges in Implementing AI and IoT in Crop Insurance

High Initial Costs

Setting up IoT infrastructure and AI-powered systems requires significant investment.

Data Privacy Concerns

With large amounts of data being collected, ensuring farmers’ data privacy is crucial.

Connectivity Issues

Many rural areas lack the necessary internet infrastructure to support IoT devices.

Need for Skilled Personnel

Farmers and insurers must be trained to use AI and IoT effectively.

Future Trends in Smart Crop Insurance

Blockchain for Secure Transactions

Blockchain technology can enhance transparency, making claim processing more secure and tamper-proof.

AI-Driven Microinsurance

AI can enable microinsurance models tailored to small-scale farmers, offering them affordable coverage.

Integration with Climate Models

Advanced climate models combined with AI will provide even more accurate risk assessments.

Government and Private Sector Collaborations

Public-private partnerships will play a crucial role in scaling smart crop insurance solutions worldwide.

Conclusion

Smart crop insurance powered by AI and IoT is revolutionizing the agricultural sector. By leveraging real-time data and automation, these models provide fairer, faster, and more accurate insurance solutions for farmers. While challenges exist, continued advancements in technology and infrastructure promise a future where farmers can rely on data-driven insurance policies to safeguard their livelihoods.

FAQs

1. How does AI improve crop insurance?

AI improves crop insurance by analyzing real-time data to assess risks, automate claims, and provide personalized premium pricing.

2. What role does IoT play in smart crop insurance?

IoT devices collect real-time data on weather, soil, and crop health, allowing insurers to make data-driven decisions and process claims faster.

3. Are smart crop insurance models affordable for small farmers?

Yes, with AI-driven microinsurance models, small-scale farmers can access affordable coverage tailored to their specific risks.

4. What are the biggest challenges in implementing AI and IoT in crop insurance?

Challenges include high initial costs, data privacy concerns, connectivity issues, and the need for trained personnel.

5. How can farmers benefit from smart crop insurance?

Farmers benefit through faster claim settlements, fair premium pricing, real-time risk alerts, and increased transparency in the insurance process.