The journey of money from simple barter to today’s complex systems is fascinating. It has shaped human civilization. This article will explore money’s history, from ancient times to digital currencies.

Societies have always tried to make exchanging goods and services easier. The story of money is about innovation and finding better ways to trade. From barter to today’s financial tools, it shows human creativity and the need for a growing economy.

Key Takeaways

- Explore the origins of money, from ancient barter systems to the first forms of commodity money.

- Understand the rise of metallic currency, including the gold and silver standards, and the birth of minting.

- Discover the revolutionary impact of paper money and the historical development of banking systems.

- Examine the digital payment evolution, including electronic banking, mobile payment solutions, and the emergence of digital wallets.

- Delve into the world of modern cryptocurrencies and their potential impact on the future of digital currency and global financial systems.

Understanding Ancient Barter Systems

The history of money goes back to the prehistoric era. In those times, early civilizations traded goods and services through barter. This system didn’t use a standard money but still helped societies grow.

Trading Goods in Early Civilizations

People in early societies traded what they had extra for what they needed. For instance, a farmer might swap their extra grain for a potter’s ceramics. This direct trading was key for their survival and growth.

Read Also: How to Know the Best Cryptocurrency Exchanges for your Investment

Limitations of the Barter Economy

- Lack of a common measure of value: Without a standard currency, it was hard to know the worth of different items.

- Difficulty in finding a coincidence of wants: For a trade to work, both sides had to want exactly what the other had, making trades hard.

- Divisibility issues: Some items, like livestock, were hard to split, making small trades tricky.

First Forms of Value Exchange

As societies grew, barter’s limits became clear. This led to the use of more standard forms of prehistoric trade and early economics. Items like livestock, spices, and precious metals started being used as a way to exchange value. This was the start of the first money forms.

| Commodity | Usage in Ancient Trade |

|---|---|

| Livestock | Used as a medium of exchange and a store of value |

| Spices | Highly valued and traded across civilizations |

| Precious Metals | Served as a durable and portable form of value exchange |

Read Also: How to Make Money on Facebook: Your Ultimate Guide

The First Forms of Commodity Money

Before formal currencies existed, early societies used various commodities for trade. These commodity monies were key in building economic systems. They set the stage for more advanced money systems later on.

Cowrie shells were a common early money. These shells were rare and valuable. They were used for buying things, decorating, and even as jewelry in ancient Africa, Asia, and the Pacific.

Grain storage was another early money. In farming communities, extra grains like wheat or rice were used as money. Farmers would store their extra crops in big places. They got receipts that could be used to buy other things.

Salt as currency was also used back then. Salt was rare and vital for food preservation. It was traded, taxed, and used as money, especially where it was hard to get.

| Commodity Money | Description | Significance |

|---|---|---|

| Cowrie Shells | Small, naturally occurring shells used as a medium of exchange | Widely used in ancient civilizations across Africa, Asia, and the Pacific |

| Grain Storage | Surplus grains, such as wheat, barley, or rice, used as a store of value and a means of exchange | Prevalent in agricultural societies, with receipts for stored grains traded as a form of currency |

| Salt | A precious and scarce commodity used for preserving food and as a medium of exchange | Widely traded, taxed, and used as currency in regions where salt was difficult to obtain |

These early money forms were crucial for economic growth. They helped create more complex money systems. This eventually led to the use of formal currencies.

The Rise of Metallic Currency

The journey of money’s evolution is truly captivating. It moved from barter systems to the use of metallic coins. This change was key in shaping our global economy. It brought us gold and silver standards, minting techniques, and the role of precious metals in trade.

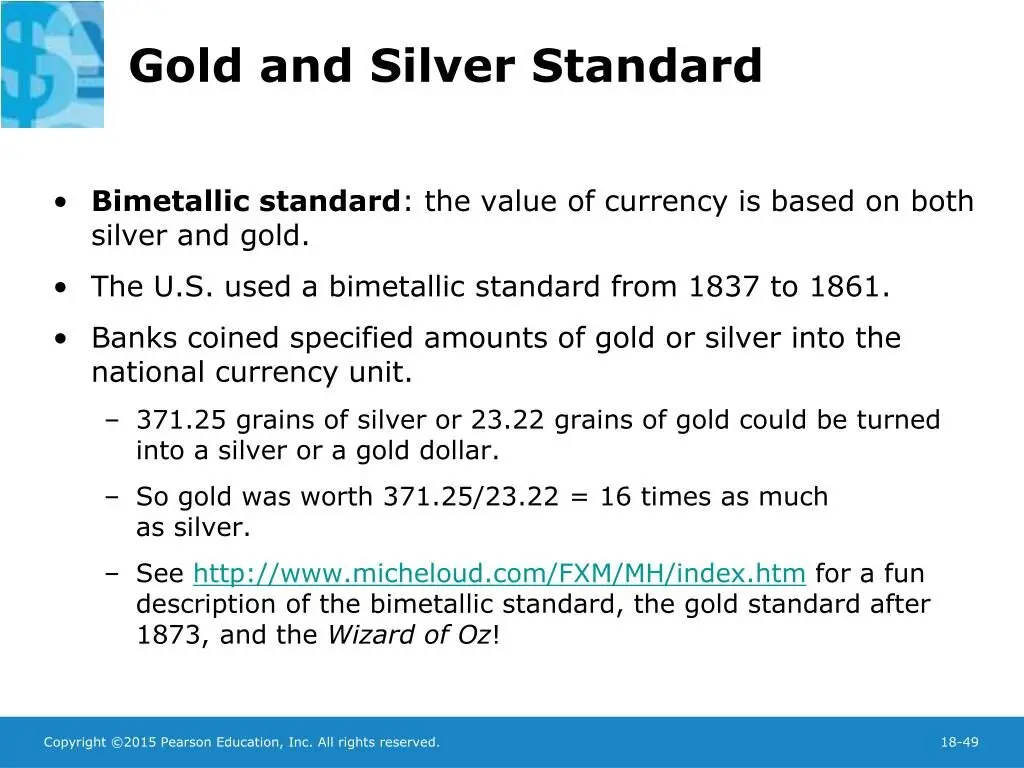

Gold and Silver Standards

Precious metals like gold and silver were first used by ancient civilizations. They were valued for being rare, lasting, and valuable. This made them perfect for money.

The gold and silver standards led to the creation of standardized coins. These coins made trade and commerce easier over long distances.

You May Like to Read: Why Do Most Girls Snub A Guy Who Tries To Approach Them

The Birth of Minting

Minting techniques marked a big step in the use of metallic currency. Ancient mints produced coins with the same weight and purity. This made coins reliable and widely accepted.

The ability to measure and control coinage of precious metals was a big leap. It helped solve the problems of barter exchanges.

Global Trade and Precious Metals

The use of precious metals helped global trade grow. Coins were easy to carry, divide, and were accepted everywhere. This helped merchants and traders do business across borders.

This use of ancient mints and coinage of precious metals started our modern financial system.

“The history of money is the history of civilization itself, as the development of currency has been intertwined with the rise and fall of empires, the growth of trade, and the evolution of human society.”

Paper Money Revolution

The invention of paper money was a big change in how we handle money. It replaced the old way of using coins and bullion. Now, people can easily buy and sell things with paper money.

Switching to paper money had many benefits. It was simpler to make, store, and move around. This made doing business easier. Also, governments could control the money supply better. They could use this control to fight inflation and help the economy grow.

| Advantages of Paper Money | Limitations of Metallic Currency |

|---|---|

| Easier production and distributionLightweight and compact for transportFacilitates government monetary policy | Heavy and bulky to carryLimited supply due to mining constraintsVulnerable to hoarding and theft |

With banknotes, governments could manage the money better. This helped them achieve their economic goals. This change was a big step forward in the history of money.

“The invention of paper money was a revolution in economic history.”

The History of Money: From Barter to Cryptocurrency

The journey of money is fascinating, filled with financial innovations that changed the world. It started with barter and moved to cryptocurrencies. This shows our drive for better ways to exchange value.

Key Evolutionary Milestones

First, we moved from barter to using animals and metals as money. Then, coins and the gold/silver standard came, making trade easier. Finally, paper money was introduced, changing everything.

Technological Breakthroughs

Technology has always been key in money’s evolution. Banks and electronic banking changed how we handle money. Now, digital wallets and cryptocurrencies bring new security and transparency.

Social Impact Through Ages

- Money helped trade and commerce grow, leading to more complex societies.

- Standardized currency led to better accounting, credit, and investments, boosting economic progress.

- The digital revolution in finance has opened doors for everyone, improving society and economy.

The story of money is amazing, deeply connected to human history. It shows our creativity, strength, and never-ending quest for better finance and economic progress.

The Birth of Banking Systems

The journey of modern finance is filled with interesting moments. It started with financial institutions, fractional reserve banking, and central banks. These steps created the complex financial world we see today.

At first, banking was simple. Merchants and goldsmiths kept valuables and lent money. But as the economy grew, more complex financial tools were needed. This led to the creation of financial institutions, key players in moving money and credit around.

Fractional reserve banking was a big step. It let banks lend out some of their money while keeping enough to meet withdrawals. This helped the economy grow by making more money available for loans.

The start of central banks was another key moment. These government-backed banks manage money, keep the financial system stable, and oversee banks. Their role in shaping the economy is huge, guiding money and influencing economic outcomes.

“The history of money is the history of civilization itself, a record of human ingenuity, ambition, and the constant search for economic security.”

The early banking systems laid the groundwork for today’s finance. Knowing about financial institutions, fractional reserve banking, and central banks helps us understand the complex finance world. It shows how these early steps shaped our financial landscape.

A bustling financial institution interior, showcasing diverse people engaging in transactions, tall glass windows revealing a modern cityscape, sleek wooden furniture, digital screens displaying fluctuating stock prices, gold accents on walls symbolizing wealth, and an atmosphere of professionalism and activity.

Digital Payment Evolution

The world of payments has changed a lot. It moved from old barter systems to new digital payment solutions. This change has made online transactions easier and has changed the fintech and e-commerce worlds.

Electronic Banking Era

Electronic banking made managing money easier and safer. Now, we can check our accounts and make payments online with just a few clicks. This has made handling our money much simpler.

Mobile Payment Solutions

Smartphones have made mobile payments popular. Apps like Apple Pay and Google Pay let us pay easily with our phones. These apps have changed how we shop and have helped the fintech industry grow.

Digital Wallets Impact

Digital wallets like PayPal have made payments even easier. They let us send money to friends and make online payments without hassle. This has made shopping online safer and more convenient.

The shift to digital payments has changed the financial world. It has made transactions easier and safer for everyone. As fintech keeps improving, we’ll see even more new payment options.

Understanding Modern Cryptocurrency

Cryptocurrency has changed the finance world, shaking up old banking and money systems. At its core is Bitcoin, the first cryptocurrency that has caught the world’s eye. It uses blockchain technology to offer a safe, open way to handle money.

Cryptocurrency stands out because it’s not controlled by one group. Unlike regular money, it uses a network of computers to keep track of transactions. This decentralized finance (DeFi) approach lets people manage their money without banks.

Now, there’s a new kind of investment in the market. People and businesses are looking into digital currencies. This shift is changing how we think about money, with Bitcoin and others leading the way.

A futuristic digital landscape featuring a glowing, golden Bitcoin symbol at the center, surrounded by intricate, interconnected blockchain nodes represented as glowing circuits. The background showcases a vibrant city skyline illuminated by neon lights, symbolizing innovation and technology. Emphasize a sense of depth and movement, with dynamic lines and light trails connecting the nodes, creating an immersive atmosphere of digital finance and decentralization.

“Cryptocurrency is not just about money. It’s about owning your own financial destiny.” – Changpeng Zhao, Founder of Binance

Exploring cryptocurrency reveals both its benefits and challenges. It makes sending money across borders easier and supports new apps. This technology is changing the financial world in big ways.

The Future of Digital Currency

The world is moving towards a digital future, and money is changing too. At the center of this change are central bank digital currencies (CBDCs). They aim to change how we deal with money.

Central Bank Digital Currencies

CBDCs are digital versions of traditional money. They use blockchain for better security and ease of use. Governments see them as a way to make money transfers faster and more inclusive.

Integration with Traditional Finance

CBDCs and digital currencies are being added to the old financial system. This brings both chances and challenges. It’s important to make sure they work well with the current system.

Environmental Concerns

The way digital currencies are made can harm the environment. The energy needed for some digital currencies is a big worry. Finding ways to make them more eco-friendly is key for a sustainable future.

The journey to make digital currencies common faces many hurdles. But, with the right balance of tech, rules, and care for the planet, we can create a better financial future.

“The future of money is digital, and central banks are poised to play a pivotal role in shaping that future.”

Global Financial Systems Today

In today’s world, money, investments, and currency exchanges are all connected. The International Monetary Fund (IMF) is at the center, helping to keep the financial system stable. The forex markets are also key, allowing for the trade of different currencies and supporting international business.

Our financial systems have changed a lot, thanks to digital payments and online banking. The rise of cryptocurrency has also changed how we think about money. This change brings new chances and challenges, as we try to balance innovation with safety and fairness in the global economy.

Navigating the Complex Financial Landscape

The global financial system is complex and always changing. It includes many different places, tools, and rules. Knowing this system well is important for everyone, from individuals to big companies and leaders.

- Central banks and monetary authorities are key in setting money policies and keeping things stable.

- Groups like the IMF and World Bank help countries with money, advice, and support, promoting global cooperation.

- Forex markets help people and businesses trade and invest across borders.

- New tech, like digital wallets and cryptocurrencies, is changing how we handle money and value.

As the financial world keeps changing, it’s important to stay up to date and flexible. This will help us face the challenges and chances that come our way.

“The global financial system is the foundation upon which the world economy is built. Understanding its intricacies is crucial for shaping a more stable and prosperous future.”

Conclusion

The journey of money is fascinating, from ancient barter systems to today’s cryptocurrencies. It shows how financial literacy and monetary evolution have shaped our economy. Money has evolved from simple commodities to complex banking systems, always seeking better ways to exchange value.

We are now at a turning point in the future of money. Digital currencies and new technologies are changing finance. They promise to make money more accessible and transactions faster. But, they also bring concerns about their environmental impact, regulation, and stability.

It’s important for everyone to understand money’s history and current changes. This knowledge helps us deal with today’s financial world. It’s key for a fair and sustainable future for all of us.

FAQ

What are the key evolutionary milestones in the history of money?

Money’s history started with barter systems and moved to modern cryptocurrencies. Key milestones include commodity money, metallic currency, and paper money. We also saw the rise of banking systems, digital payments, and cryptocurrency.

How did ancient barter systems work, and what were their limitations?

In ancient times, people traded goods and services directly. This worked well for small trades but had big problems. Finding someone who wanted what you had and valuing goods were hard.

What were some of the first forms of commodity money?

Early forms of money were shells, grains, and salt. They were chosen for being rare, lasting long, and widely accepted. This laid the groundwork for more complex money systems.

How did the shift to metallic currency transform the global economy?

Metallic currencies, like gold and silver, changed trade and economies worldwide. Minting and standards made exchange easier and more widespread. This helped grow global trade and commerce.

What were the key benefits and challenges of the paper money revolution?

Paper money was lighter, cheaper to store, and easier to manage than metal. But, it also brought inflation risks and the chance for government control. Strong rules were needed to keep the financial system stable.

How have digital payment solutions transformed the economy?

Digital payments, like online banking and mobile wallets, changed how we shop and manage money. They made transactions faster and easier. But, they also brought new security and regulatory issues.

What are the key features and potential impact of modern cryptocurrency?

Cryptocurrency, like Bitcoin, is a digital money that doesn’t need banks. It offers new ways to invest and challenges old money systems. It raises questions about the future of digital finance.

What are the potential future developments in the world of digital currency?

The future of digital money includes central bank digital currencies and more use of cryptocurrency. It also means finding ways to make mining more sustainable. These changes will shape our financial systems and how we pay for things online.