Introduction: Can Games Really Teach Us About Money?

Can a video game really play a role in teaching financial literacy—helping you learn how to budget, invest, or manage limited resources better than a classroom lecture? At first glance, it sounds unlikely. Games are supposed to be fun, after all—not formal financial training tools.

Yet when you look closely at how modern games work, a different picture emerges. Teaching financial literacy through in-game economies is not just possible; it is already happening, often without players realizing it.

Every time you decide whether to spend coins now or save them for later, trade scarce resources, or recover from a bad in-game purchase, you are practicing the same mental skills required for real-world financial decision-making.

This article argues that in-game economies function as low-risk financial simulations. They allow players—especially young people—to learn budgeting, opportunity cost, delayed gratification, and strategic planning through experience rather than theory.

Understanding In-Game Economies: A Digital Mirror of Real Life

What Is an In-Game Economy?

An in-game economy is a system where players earn, spend, trade, and manage virtual resources. These resources may include currency, items, time, energy, or skills.

In many ways, teaching financial literacy through in-game economies works because these systems replicate real constraints. You cannot have everything at once. Choices matter. Scarcity exists.

Core Elements of Game Economies

- Currency: Gold, coins, credits, or points

- Income Streams: Rewards from quests, farming, or achievements

- Expenses: Upgrades, equipment, repairs, or entry fees

- Scarcity: Limited resources or time-based constraints

- Risk and Reward: High-cost decisions with uncertain outcomes

These mechanics quietly teach players how economic systems function without overwhelming them with jargon.

Why Teaching Financial Literacy Through In-Game Economies Works

Learning by Doing, Not Memorizing

Traditional financial education often relies on abstract concepts—interest rates, savings ratios, and balance sheets. Games flip this model.

When players overspend early in a game and struggle later, the lesson is immediate and memorable. Teaching financial literacy through in-game economies leverages experiential learning, which leads to deeper understanding.

Failure Is Safe and Instructive

In real life, financial mistakes can be devastating. In games, mistakes are reversible. This safety encourages experimentation.

- Why saving matters

- How poor planning creates future stress

- The value of patience and delayed rewards

Key Financial Skills Learned Through Game-Based Economies

Budgeting and Resource Allocation

Games constantly ask players to decide how to allocate limited resources. Do you buy better equipment now or save for a future upgrade?

Teaching financial literacy through in-game economies trains players to prioritize needs, plan spending, and understand trade-offs.

Opportunity Cost

Every choice in a game has a cost—not just in currency, but in missed opportunities. This mirrors real-world financial decisions.

Delayed Gratification

Many games reward patience. Waiting and saving often lead to better long-term outcomes than impulsive spending.

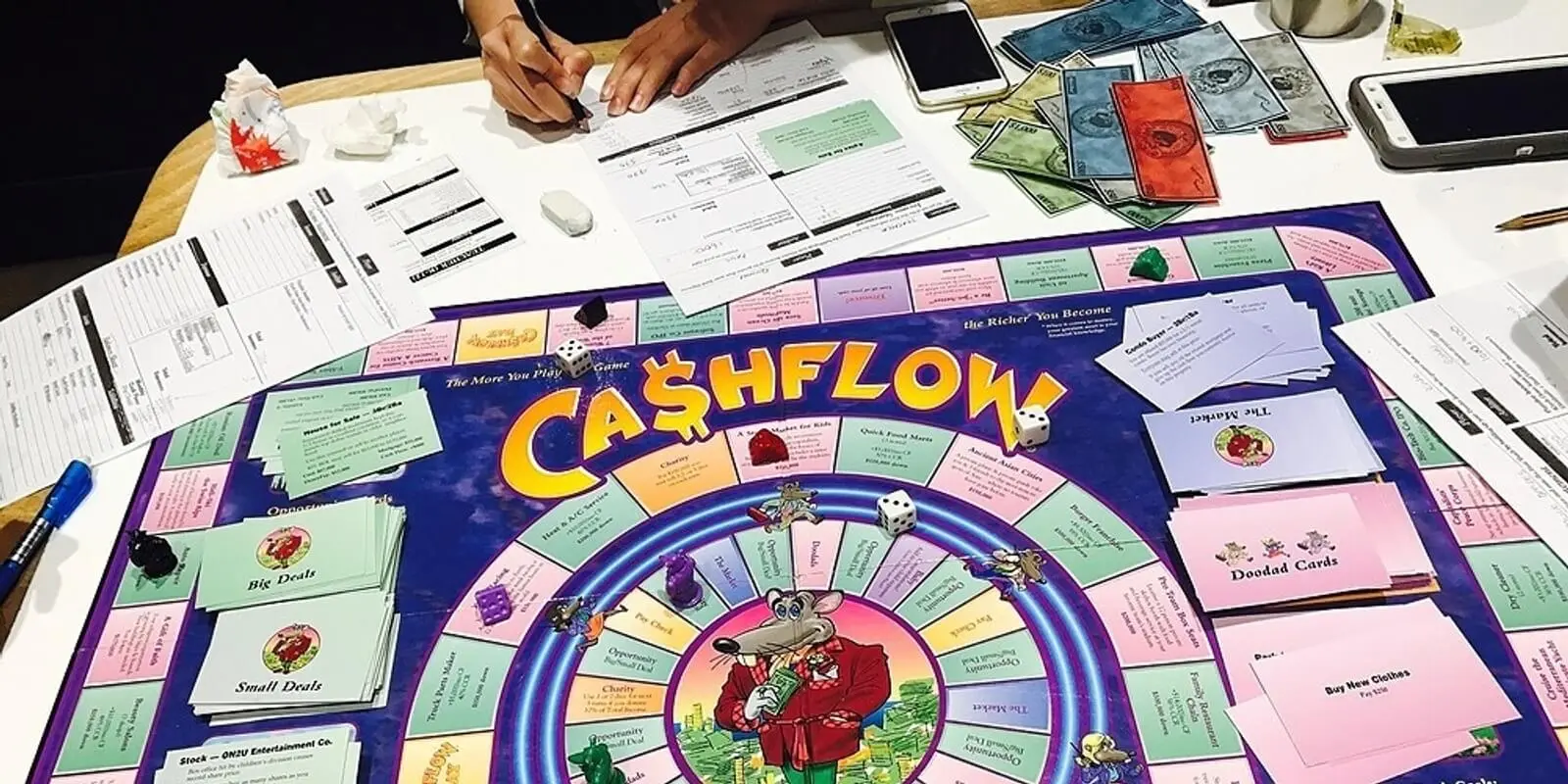

Game-Based Financial Literacy in Action

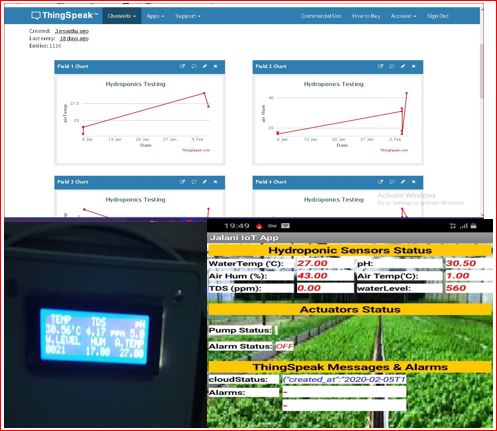

Strategy Games and Economic Planning

Strategy games require players to balance income, expenses, and growth over time. Mismanagement leads to collapse.

Teaching financial literacy through in-game economies is especially effective here because success depends on economic decisions.

Simulation Games and Real-World Parallels

Life simulation and city-building games replicate taxation, employment, housing, and inflation.

Players develop systems thinking—an advanced financial skill.

Answering Common Questions About Game-Based Financial Education

Is Game-Based Financial Literacy Effective?

Yes. Games engage attention, provide instant feedback, and encourage repeated practice.

Can Games Replace Traditional Financial Education?

No. Games should complement traditional education, not replace it.

Where to Find Financial Literacy Games

Digital Board Games and Online Platforms

Many digital board games focus on budgeting, investing, and trade-offs.

Free Educational Games for Children

Several websites offer free games that introduce saving, earning, and spending.

App Store Money Skills Games

Mobile app stores feature highly rated games focused on financial education.

A Personal Insight: Why Games Teach What Classrooms Often Can’t

A close study of financial education programs shows that learners improve fastest when they feel ownership over decisions.

Teaching financial literacy through in-game economies works because players emotionally engage with outcomes. Loss feels real enough to teach caution, while success feels earned.

How Parents and Educators Can Apply Game-Based Financial Learning

Choose the Right Games

- Reward planning over impulse

- Include scarcity and trade-offs

- Penalize poor decisions logically

Encourage Reflection

Ask players what worked, what failed, and how decisions relate to real money choices.

Addressing Concerns About In-Game Purchases

Some games include aggressive monetization. These can become teaching moments about impulse control and marketing tactics.

The Future of Financial Education Is Interactive

Games are becoming sophisticated learning tools with realistic simulations and adaptive systems.

Conclusion: Why Games May Be the Best Financial Classroom We Have

Teaching financial literacy through in-game economies aligns with how humans naturally learn—through experience, experimentation, and consequence.

By treating games as training grounds rather than distractions, we can build stronger financial instincts before real money is on the line.

FAQs

What age is best for learning financial literacy through games?

Children as young as seven can benefit from age-appropriate financial games.

Are mobile games effective for teaching money skills?

Yes, especially games that focus on decision-making and budgeting.

Do games teach investing concepts?

Some advanced strategy and simulation games introduce risk and long-term growth.

How can parents monitor learning outcomes?

By discussing in-game decisions and linking them to real-life finances.

Can adults benefit from financial literacy games?

Absolutely. Many games offer complex economic systems suitable for adults.