Investing in stocks can be an excellent way to grow your wealth over time, but it can also seem overwhelming for beginners. With the right knowledge and a strategic approach, anyone can start investing in stocks and work toward their financial goals. In this blog post, we’ll walk you through a beginner’s guide on how to invest in stocks, covering key concepts, steps, and tips to get started on your investing journey.

1. Understand the Basics: Before you start investing, it’s crucial to understand the fundamental concepts of stocks. Stocks represent ownership in a company, and when you buy shares, you become a shareholder. The goal is to buy stocks at a lower price and sell them at a higher price to make a profit.

2. Set Clear Goals: Define your investment goals. Are you looking for long-term growth, retirement savings, or generating passive income? Your goals will influence your investment strategy and timeline.

3. Educate Yourself: Take the time to educate yourself about different investment strategies, market trends, and basic financial terms. There are numerous resources available, including books, online courses, and financial websites.

4. Assess Risk Tolerance: Understand your risk tolerance—the amount of risk you’re comfortable taking on. Stocks can be volatile, so it’s important to choose an investment strategy that aligns with your risk tolerance.

5. Choose a Brokerage Account: To invest in stocks, you’ll need a brokerage account. Research and choose a reputable online brokerage that offers a user-friendly platform and low fees.

6. Start Small and Diversify: As a beginner, start with a small investment amount. Diversification is key to managing risk. Invest in a variety of stocks across different industries to spread risk and potential rewards.

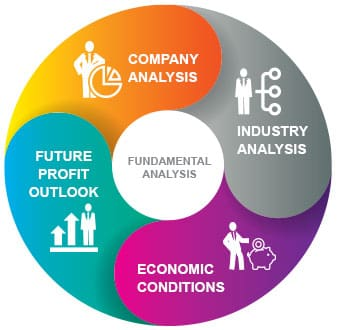

7. Fundamental Analysis: Learn to evaluate companies using fundamental analysis. Research a company’s financial health, earnings, growth prospects, and competitive landscape. This information will help you make informed investment decisions.

Read More Posts Like This

- AI Scam And Kidnapping – Video and Audio Evidence Going Extinct

- How To Make Money From Cryptocurrency

8. Technical Analysis: Consider learning basic technical analysis, which involves analyzing stock price trends and patterns to predict future price movements. While fundamental analysis focuses on a company’s financials, technical analysis looks at historical price data.

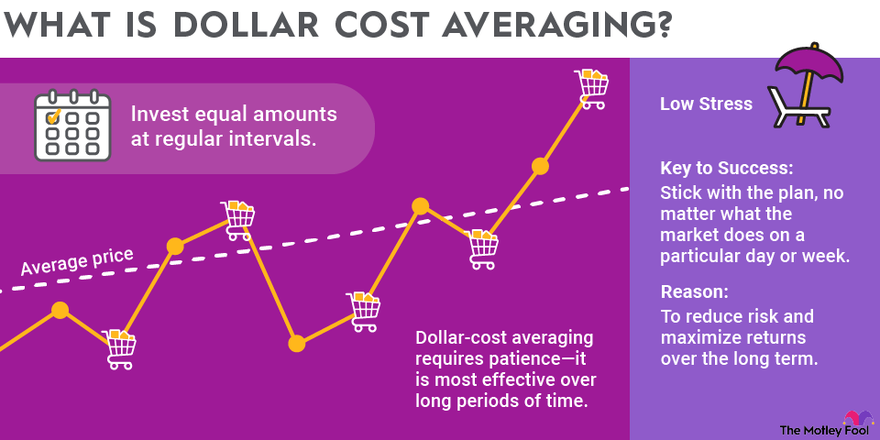

9. Dollar-Cost Averaging: Rather than investing a lump sum, consider using a strategy called dollar-cost averaging. Invest a fixed amount of money at regular intervals, regardless of market conditions. This approach helps reduce the impact of market volatility on your investments.

10. Monitor and Adjust: Regularly review your investment portfolio and make adjustments as needed. Rebalance your portfolio to maintain your desired asset allocation and ensure it aligns with your goals.

11. Patience is Key: Investing in stocks is a long-term endeavor. Don’t expect instant results. Stay patient and committed to your investment strategy, and avoid making impulsive decisions based on short-term market fluctuations.

12. Seek Professional Advice: If you’re unsure about your investment decisions, consider seeking advice from a certified financial advisor. They can provide personalized guidance based on your financial situation and goals.

Conclusion

In conclusion, investing in stocks can be a rewarding journey with the right approach. By understanding the basics, setting clear goals, educating yourself, and practicing prudent strategies, you can confidently navigate the world of stock investing. Remember that patience, research, and continuous learning are key components of successful stock investing. As you gain experience and knowledge, your confidence in making investment decisions will grow, bringing you closer to your financial aspirations.