Introduction

Imagine graduating high school and stepping into adulthood with no idea how to budget, save, or even write a check. Sounds scary, right? Unfortunately, this is a reality for many young people. Schools teach algebra and history, but practical financial skills often fall by the wayside.

In today’s world, where financial decisions start early and impact long-term well-being, teaching financial literacy in schools is no longer optional—it’s essential. Let’s dive into why financial literacy matters, what it involves, and how schools can prepare students to navigate the complexities of real-world money management confidently.

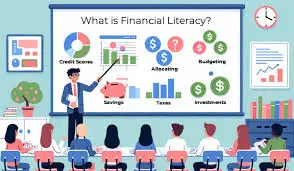

What Is Financial Literacy?

The Basics of Financial Literacy

Financial literacy is the ability to understand and manage personal finances effectively. It includes skills like budgeting, saving, investing, and understanding credit and debt. Think of it as a toolkit for making informed financial decisions.

Why Is Financial Literacy Important?

Life is full of financial decisions, from choosing a car loan to planning for retirement. Without basic financial knowledge, these choices can lead to costly mistakes. Financial literacy empowers students to avoid debt traps, build wealth, and achieve their financial goals.

Why Schools Should Teach Financial Literacy

The Growing Debt Crisis

Did you know that Americans owe over $1.7 trillion in student loan debt? Teaching financial literacy in schools can help students understand loans, interest rates, and repayment plans, reducing the likelihood of overwhelming debt.

Early Habits Shape Future Behavior

Habits formed in childhood often carry into adulthood. Teaching money management early sets students up for lifelong financial success.

Bridging the Knowledge Gap

Not all families discuss finances at home. Schools can bridge this gap, ensuring every student has equal access to vital financial skills.

Core Components of Financial Literacy Education

Budgeting Basics

Budgeting is the cornerstone of financial literacy. Students should learn how to track income, categorize expenses, and prioritize savings.

Understanding Credit and Debt

From credit cards to loans, understanding how borrowing works—and its potential pitfalls—is crucial. Topics like credit scores, interest rates, and repayment plans should be covered.

Saving and Investing

Teaching students the difference between saving for short-term goals and investing for long-term growth can change their financial trajectory. Concepts like compound interest and diversification are key.

Taxes and Income Management

Taxes are an inevitable part of life. Students should know how to read a pay stub, file taxes, and understand deductions.

The Benefits of Financial Literacy for Students

Improved Decision-Making

Financial literacy enables students to make informed choices, whether it’s selecting a college, buying a car, or choosing a career path.

Reduced Stress

Money is a leading cause of stress for adults. Teaching students how to manage their finances reduces anxiety and promotes mental well-being.

Building Financial Independence

Financially literate students are less likely to rely on parents or others for support. They’re better equipped to handle the responsibilities of adulthood.

Challenges in Implementing Financial Literacy Education

Lack of Standardized Curriculum

One major hurdle is the absence of a nationwide standard for financial literacy education. What’s taught and how well it’s taught varies widely.

Limited Teacher Training

Not all teachers feel equipped to teach financial literacy. Providing professional development and resources is critical for effective implementation.

Competing Priorities

Schools already juggle a packed curriculum. Finding time for financial literacy without sacrificing other subjects is a common challenge.

How Schools Can Integrate Financial Literacy

Standalone Courses

One option is to offer a dedicated financial literacy course, covering everything from budgeting to investing.

Integration into Existing Subjects

Financial concepts can be woven into math, economics, or social studies classes. For example, teaching compound interest in algebra makes the topic both practical and engaging.

Hands-On Learning

Experiential learning, like mock investing or creating a personal budget, makes financial literacy tangible and memorable.

The Role of Technology in Financial Education

Financial Literacy Apps

Apps like Mint and YNAB (You Need A Budget) can teach students how to manage money in a digital-first world.

Online Courses and Resources

Websites like Khan Academy and the National Endowment for Financial Education offer free tools and lessons that schools can incorporate into their curriculum.

Gamification of Learning

Games that simulate real-world financial scenarios make learning fun and interactive. Students can “test drive” financial decisions without real-world consequences.

Parental Involvement in Financial Education

Encouraging Open Discussions

Parents should talk to their kids about money early and often. Sharing personal experiences both successes and mistakes can be incredibly valuable.

Reinforcing School Lessons

Parents can help reinforce what students learn at school by involving them in real-life financial decisions, like grocery budgeting or vacation planning.

Real-World Examples of Financial Literacy Programs

Success Stories from U.S. Schools

States like Utah and Missouri have implemented financial literacy courses with great success. Students report feeling more confident about managing their finances.

International Perspectives

Countries like Canada and Australia have also made strides in financial education. Their curricula emphasize practical skills, such as saving and understanding taxes.

Long-Term Impact of Financial Literacy Education

Breaking the Cycle of Poverty

Financial literacy can be a powerful tool for breaking generational cycles of poverty. Knowledge empowers students to make choices that build wealth over time.

Economic Benefits for Society

When individuals make better financial decisions, the economy benefits. Reduced debt levels and increased savings lead to greater financial stability.

Preparing for a Changing Financial Landscape

As the financial world evolves with technology, understanding basic principles remains critical. Financial literacy equips students to adapt to new tools and systems.

Addressing Common Myths About Financial Literacy

“It’s Only for Adults”

Many people think financial education is irrelevant for kids, but habits formed early lay the groundwork for future success.

“You Need to Be Good at Math”

While math helps, financial literacy is more about understanding concepts and making informed decisions than solving equations.

“It’s Too Complicated”

With the right approach, financial literacy can be simplified and engaging, making it accessible to everyone.

Practical Activities for Teaching Financial Literacy

Simulating Real-Life Scenarios

Activities like mock budgeting for a month’s expenses or planning a vacation on a fixed income teach students practical skills.

Guest Speakers and Workshops

Bringing in financial advisors or entrepreneurs to share real-world insights can inspire and inform students.

Field Trips to Financial Institutions

Visiting banks or investment firms gives students a behind-the-scenes look at how money management works in practice.

The Future of Financial Literacy in Schools

Advocacy for Mandated Courses

More advocacy is needed to make financial literacy a standard part of the curriculum nationwide. Policymakers and educators must prioritize this essential skill.

Leveraging Artificial Intelligence

AI-powered tools can personalize financial education, tailoring lessons to each student’s learning style and pace.

Collaboration with the Private Sector

Partnerships between schools and financial institutions can provide resources and expertise to enhance financial literacy programs.

Conclusion

Financial literacy isn’t just a life skill—it’s a lifeline. Teaching students how to manage money equips them to handle the challenges of adulthood with confidence and competence. Schools have a unique opportunity to prepare students not just for exams, but for life. Let’s ensure every student graduates with the financial know-how to succeed in the real world.

Also Read: Should Men Have a Say in Women’s Reproductive Rights?

FAQs

1. Why is financial literacy important for students?

Financial literacy helps students make informed decisions about money, reducing stress and setting them up for future success.

2. What topics should financial literacy cover in schools?

It should include budgeting, saving, investing, understanding credit, taxes, and managing debt.

3. At what age should financial education begin?

Financial education can start as early as elementary school, with age-appropriate lessons that grow in complexity over time.

4. How can parents support financial literacy at home?

Parents can involve their kids in budgeting, saving, and shopping decisions, reinforcing what they learn at school.

5. Are there free resources for teaching financial literacy?

Yes, websites like Khan Academy, NEFE, and apps like Mint offer free tools and lessons to enhance financial literacy education.

Meta Description:

Discover why teaching financial literacy in schools is essential for student success. Learn how financial education prepares students for real-world money management.